Let’s start with a strategic principle: If hiring is your primary operational fix, you do not have a strategy.

In Part 1, we established the mathematical reality: a 40% turnover rate, combined with a 90-day hiring velocity, results in a 3× productivity hit that consumes your operational capacity. The resulting 10% effective deficit makes catching up impossible, even before market forces are considered.

The critical insight of this second analysis is that even if an organization attempts to spend its way out of this deficit, the current external talent market renders that plan economically and practically impossible.

The Unwinnable Competition for Skilled Labor

Maintenance technicians are in a high-stakes, multi-sector talent war. The competition is no longer local property management firms; it is globally capitalized, highly competitive entities that organizations in multifamily housing cannot feasibly outbid.

1. Capital-Backed Service Rollups

The market is being fundamentally altered by Private Equity (PE)-backed service rollups. These entities operate with vast capital advantages:

- They acquire specialized service companies, consolidating talent supply.

- They offer top-of-market wages and attractive compensation packages (bonuses, structured schedules).

- They are actively hoarding HVAC technicians, plumbers, and electricians.

Multifamily firms are competing against a national, capitalized strategy designed to dominate the labor market, making salary matching unsustainable.

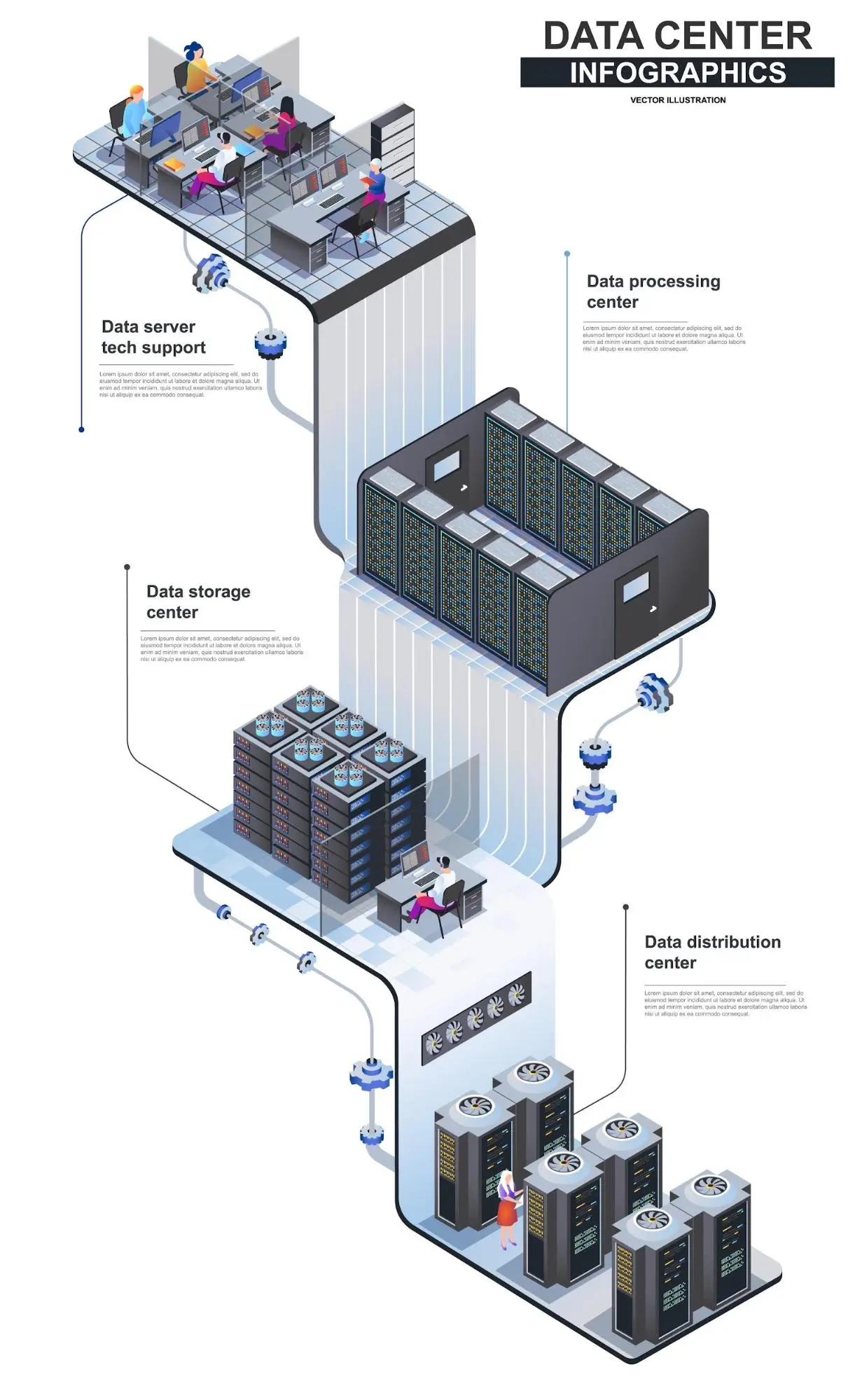

2. The Data Center Talent Vacuum

The demand for specialized labor from the technology sector represents an unprecedented resource drain. The U.S. is currently spending approximately $40 billion per month on data center construction

These projects demand high volumes of:

- Electricians and HVAC specialists.

- Low-voltage and general tradespeople.

Data centers offer wage premiums, clean, predictable working environments, and extensive career ladders. This competition operates in a separate economic weight class entirely.

3. The Federal Government’s Sustained Demand

Organizations must also compete directly with the U.S. government. The Department of Defense (DoD) is on a strategic mission to hire 400,000 skilled tradespeople by 2031.

Crucially, this is not new construction demand; it is necessary talent replacement and sustainment hiring. These roles are required to operate, maintain, and service existing federal infrastructure, facilities, and housing units.

This demand still draws directly from the same national pool of talent and offers:

- Comprehensive federal benefits packages.

- Predictable work hours and stability.

- Extensive training pipelines and veteran preference policies.

You cannot out-recruit the sustained, structural demand of the federal government.

The Economic Squeeze in Multifamily

Simultaneously, the financial environment for multifamily ownership is tightening:

- Softening rents and concessions are eroding revenue.

- Insurance and interest rates are climbing dramatically.

- Property taxes are rising consistently.

This pressure dictates a clear necessity to deliver more output with less financial input. Under these conditions, hiring is the most expensive and least controllable method for adding productivity.

When the 3× productivity deficit from Part 1 is combined with the impossible recruiting landscape, relying on hiring becomes a classic case of Hopeium: Leadership wishcasting dressed up as a plan.

The Strategic Shift: Operating Your Way Out

The only lever available to executive leadership is to control the variables within the organization. This requires a definitive shift away from Hopeium to a strategy centered on Operational Excellence.

1. Technology Integration

Technology serves as the output multiplier for existing staff. Effective tools include:

- AI-enabled diagnostics to reduce errors and unnecessary truck rolls.

- Workflow automation for scheduling, triage, and administrative burden reduction.

- Guided support systems that enable junior technicians to perform tasks typically reserved for seniors.

- Solutions that speed up unit turn cycles and increase inspection predictability.

2. Process Improvement

Most maintenance failures stem from poor process, not poor personnel. Strategic process fixes must focus on:

- Standardizing work order flows and eliminating unclear handoffs.

- Drastically reducing rework through quality control on unit turns and move-in verification.

- Implementing consistent, data-driven Preventative Maintenance (PM) schedules.

- Eliminating administrative drag that consumes valuable technician hours.

3. Strategic, Flexible Staffing

This approach uses external resources precisely and strategically, avoiding dependency:

- Using vendors for strategic surge support during seasonal peaks.

- Employing specialty contractors for targeted, complex work (e.g., HVAC system replacements).

- The goal is for technology and process to reduce the gaps, while flexible staffing simply fills the remaining, defined needs.

The Outcome: Resiliency and Predictable NOI

By making the definitive shift from a hiring-centric model to a strategy of Operational Excellence, organizations achieve:

- Predictability: Faster, more reliable work order completion and turn cycles.

- Control: Independence from the volatility of the external labor market.

- Financial Stability: Reduced resident churn, increased renewals, and a stabilized NOI.

The math and the market both confirm: Hiring cannot be your strategy. Technology, process, and operational excellence are the only levers you control.