A Changing Housing Landscape

The U.S. housing market is undergoing a major transformation. Over the past decade, the demand for single-family rental (SFR) homes has skyrocketed, driven by factors such as rising home prices, increasing mortgage rates, and shifting lifestyle preferences. Many Americans, particularly younger generations and those moving to high-growth Sunbelt regions, are seeking the benefits of a single-family home without the long-term financial commitment of ownership.

This trend has drawn significant attention from institutional investors, who see SFR communities as a lucrative and resilient asset class. Historically, major investment firms have entered this space by purchasing scattered-site homes or working with homebuilders in forward-purchase agreements. However, a new wave of investment strategy is emerging—one where institutional players are directly involved in homebuilding itself.

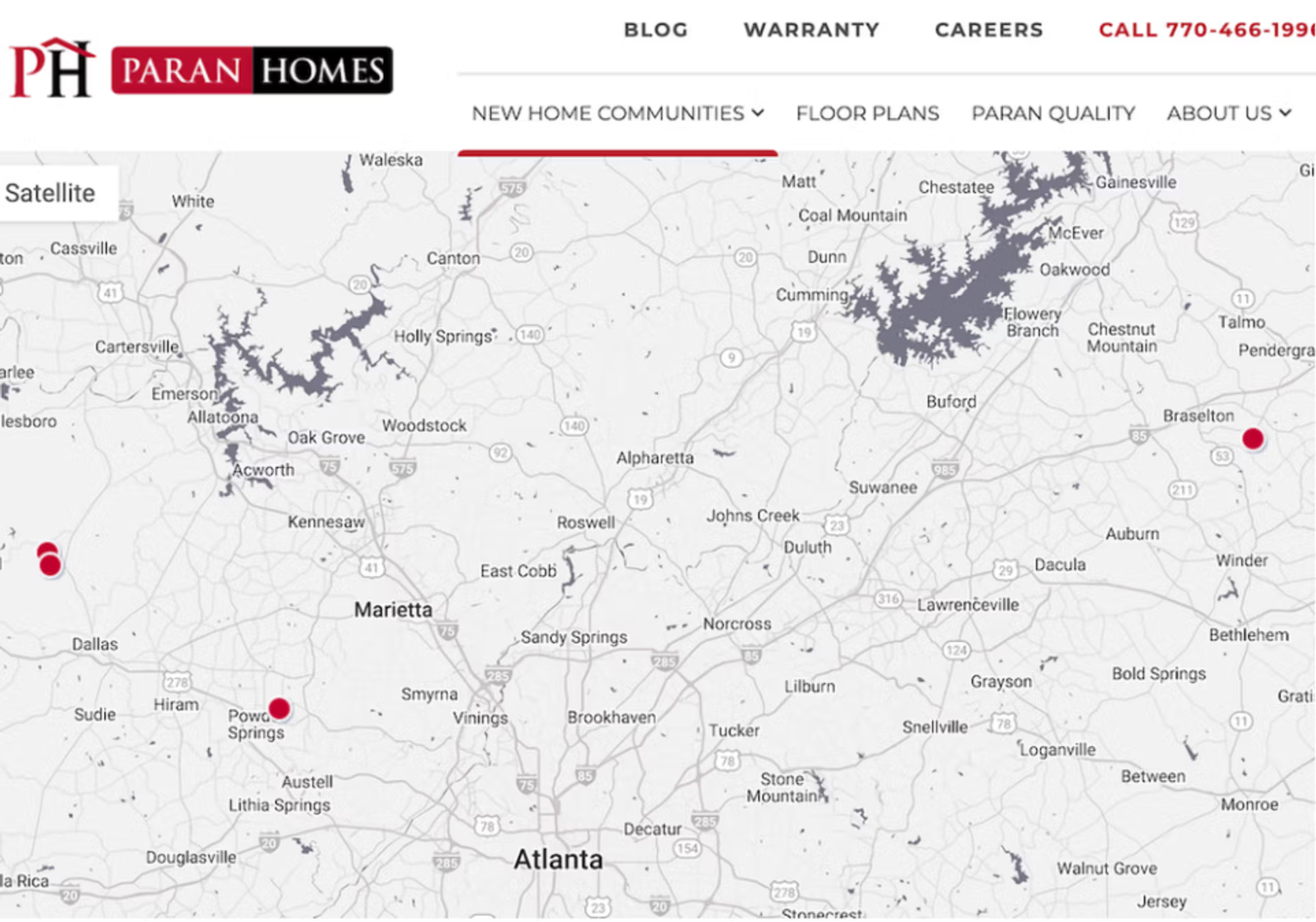

JP Morgan Asset Management, one of the largest financial institutions in the world, has now taken a decisive step into this domain, signaling a broader shift in the market. By partnering with Georgia Capital and its homebuilding affiliate, Paran Homes, the firm has launched the Laseter Development Group, a dedicated homebuilding and development venture aimed at scaling SFR communities. This move underscores a growing trend of Wall Street firms exerting greater influence in the homebuilding industry, which could have profound implications for builders, homeseekers, and renters alike.

A Disruptive Shift in Homebuilding

The introduction of institutional capital into the SFR development process presents both opportunities and challenges for the broader housing market. Traditionally, homebuilders have operated independently or partnered with private equity groups to construct homes for individual buyers. However, with firms like JP Morgan actively participating in the construction process, the dynamics of supply, pricing, and competition are being reshaped.One of the biggest implications of this shift is cost control and operational efficiency. By having direct involvement in land acquisition, design, and construction, JP Morgan can optimize expenses and streamline development in a way that forward-purchase agreements or scattered-site investments cannot. This efficiency could lead to faster community buildouts and potentially lower per-unit costs, giving JP Morgan and its partners a competitive edge over traditional homebuilders who still rely on more conventional financing structures.However, this institutional involvement also raises concerns within the industry. Some small to mid-sized homebuilders worry about increased competition from well-capitalized entities that have the financial backing to acquire large tracts of land and execute projects at scale. There’s also a fear that such developments might further exacerbate accessibility challenges by diverting homebuilding efforts away from for-sale housing toward rentals, limiting options for many homeseekers.Moreover, this strategy reflects a broader trend of major financial institutions becoming key players in the real estate sector, raising questions about market control. If companies like JP Morgan dominate SFR development, will they have an outsized influence on rental pricing, availability, and neighborhood planning? These questions remain critical as institutional investment continues to grow in the space.

JP Morgan’s Expanding Influence

JP Morgan’s involvement in SFR development is not an isolated event. In 2022, the firm announced a $1 billion joint venture with Haven Realty Capital to acquire and develop build-to-rent communities. This partnership laid the foundation for what is now a nearly $2 billion portfolio encompassing 65 SFR communities and over 6,000 homes across the country.Now, with the launch of the Laseter Development Group, JP Morgan is taking things a step further—actively building and shaping communities from the ground up. The first developments are set to break ground in Atlanta and Nashville, two of the fastest-growing metropolitan regions in the country. These cities, characterized by strong job markets, population growth, and rising housing demand, offer an ideal environment for large-scale SFR investment.This shift signals that institutional players are no longer just buyers in the SFR market—they are becoming homebuilders themselves. If this model proves successful, it could pave the way for more firms to follow suit, fundamentally altering how homes are built, financed, and delivered to the market.

What This Means for Homeseekers and the Housing Market

As JP Morgan and other institutional investors continue to deepen their involvement in homebuilding, several potential outcomes could shape the housing market:

- Increased Institutional Investment in Housing Development

If JP Morgan’s homebuilding venture proves profitable, other investment firms may replicate this strategy. This could lead to a new era of large-scale, professionally managed rental communities across the U.S., offering a high-quality alternative for homeseekers looking for flexibility and stability without ownership. - Changes in Homebuilder Strategies

Traditional homebuilders may need to rethink their strategies in response to the growing presence of institutional investors. Some may opt to collaborate with large investment firms rather than compete with them, forming new joint ventures that allow for faster, more scalable development. Others may focus more on niche markets, custom homes, or for-sale-only models to differentiate themselves. - Impacts on Accessibility and Affordability

While the expansion of SFR communities could provide more rental options in high-demand markets, it may also limit the supply of for-sale homes, particularly for homeseekers considering ownership as a long-term goal. This could make accessibility to ownership more challenging, further emphasizing lifestyle-based housing choices rather than asset accumulation. - Regulatory and Policy Considerations

The increasing influence of institutional investors in housing may prompt new discussions around regulations and policies. Lawmakers and housing advocates may push for measures to ensure fair pricing, prevent monopolistic control, or encourage a balanced mix of rental and ownership opportunities in new developments. - Shifts in Consumer Preferences

As professionally managed rental communities become more common, consumer preferences may shift. Homeseekers may gravitate toward build-to-rent communities that offer amenities, maintenance services, and long-term leasing stability, rather than dealing with individual landlords or traditional apartment living.

A New Era in Homebuilding?

JP Morgan’s foray into homebuilding represents a significant evolution in the real estate sector, blending financial power with construction expertise to reshape the single-family rental market. Whether this move ultimately benefits or challenges traditional homebuilders and homeseekers remains to be seen. However, one thing is clear: institutional investors are no longer just passive players in real estate; they are actively shaping the future of homebuilding, and the industry must adapt accordingly.

As the first developments from Laseter Development Group take shape, the industry will be watching closely. If successful, this initiative could mark the beginning of a new era where financial giants play an increasingly dominant role in housing development—transforming not just how homes are built, but who builds them.