The Costs of Maintenance Fraud

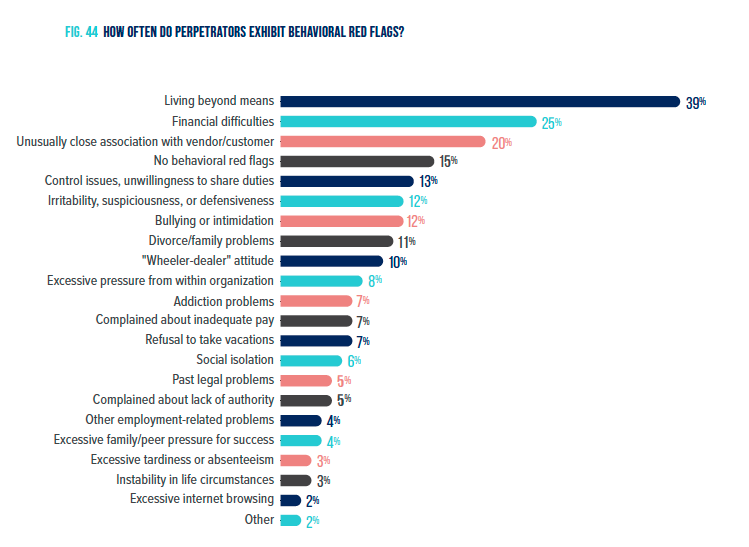

Fraud in property management doesn’t usually happen because bad people take advantage of good situations. More often, it occurs when good people find themselves in bad situations—facing financial pressures, unclear processes, or a lack of oversight. Without strong systems in place, even well-intentioned individuals may make decisions that result in fraud, either knowingly or unknowingly.

Why This Matters

When fraud is unchecked, property management companies & owners face:

- Unnecessary financial losses due to inflated invoices, ghost vendors, and duplicate billing.

- Operational inefficiencies that slow down legitimate maintenance work and reduce service quality.

- Legal and reputational risks, as fraudulent activities can lead to disputes with property owners and even regulatory penalties.

- A breakdown in trust between management teams, vendors, and tenants, leading to higher turnover and dissatisfaction.

- Non-compliance with Sarbanes-Oxley (SOX) regulations for publicly traded companies, which mandate strict financial oversight and segregation of duties to prevent fraudulent activities.

- Findings from forensic auditors have shown that field service fraud is a major source of financial leakage in property management, particularly in decentralized operations with minimal oversight (Source: Association of Certified Fraud Examiners, 2022 Report to the Nations)..

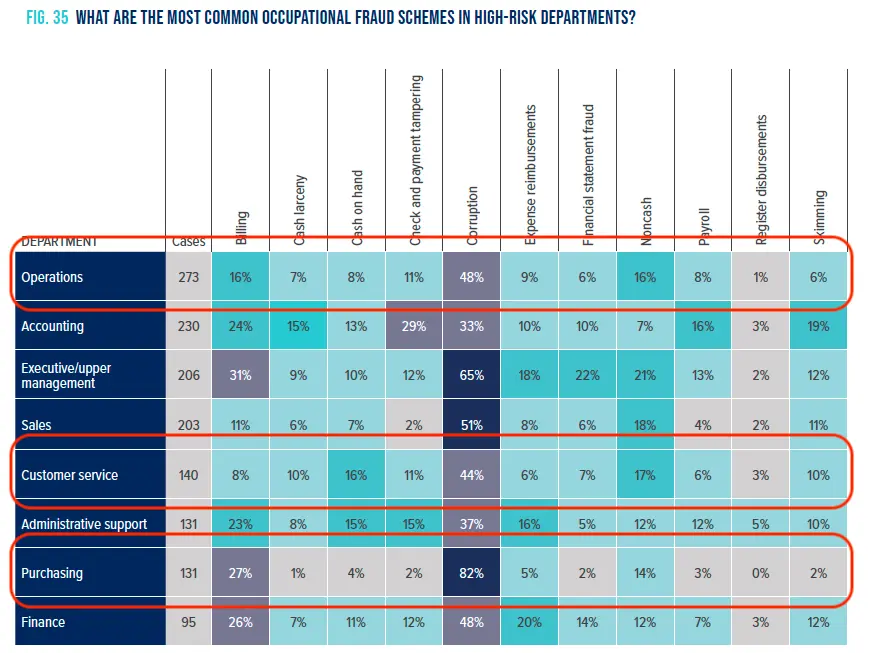

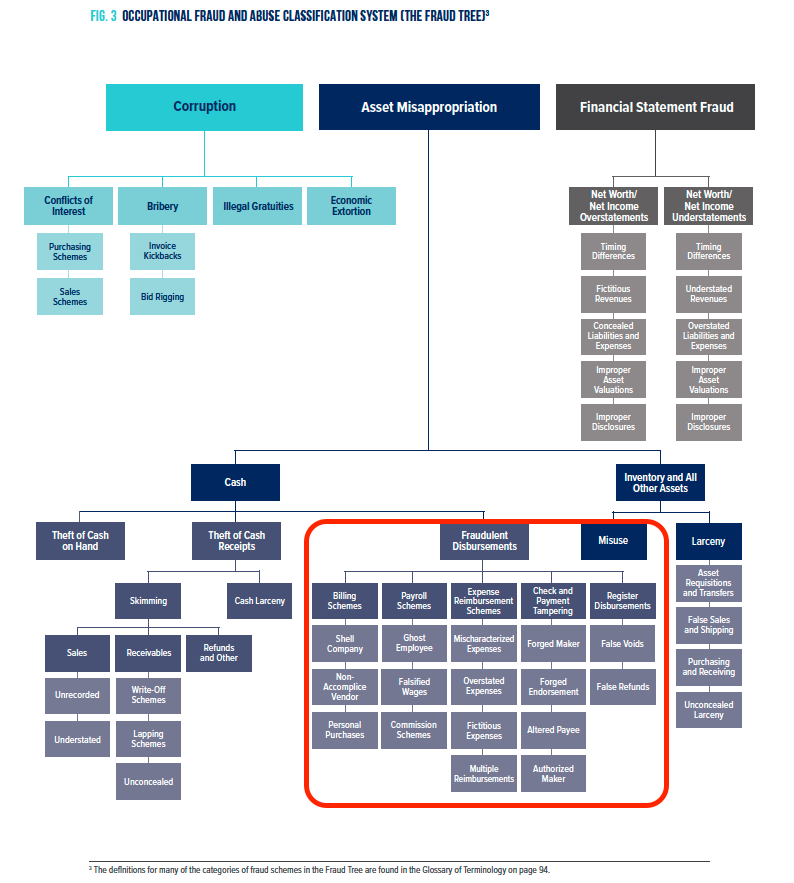

According to the 2022 Report to the Nations by the Association of Certified Fraud Examiners, asset misappropriation schemes account for 86% of all occupational fraud cases, with a median loss of $100,000 per case. Billing schemes, noncash misappropriation, and payroll fraud are among the most common methods, highlighting the vulnerability of maintenance operations in property management.

What Does Fraud Look Like?

Fraud in property management can be subtle or blatant. Here are some real-world examples:

- Overbilling – A vendor charges for more materials or labor than was actually used.

- Ghost Vendors – Fake companies or aliases are used to submit fraudulent invoices.

- Kickback Schemes – An employee approves inflated vendor invoices in exchange for personal benefits.

- Duplicate Invoices – The same invoice is submitted multiple times with minor changes to avoid detection.

- Unnecessary Repairs – Work is performed and charged when it is not required or justified.

- Material Substitution – Charging for premium materials but using lower-quality or second-hand replacements.

- Timecard Fraud – Maintenance staff or vendors bill for hours they didn’t actually work.

- Falsified Inspections – Reporting maintenance as complete when no work was done.

- Emergency Fee Manipulation – Routine work is classified as an emergency to increase costs.

- Conflicts of Interest – An employee awards contracts to a vendor they have a financial interest in.

Where Fraud Happens: A Checklist

Fraud thrives in environments with poor oversight and lack of centralized controls. Be especially vigilant in these situations:

- Where you have localized or vague work order descriptions

- Where you have localized work approval

- Where you have localized vendor selection

- Where you have localized rogue spend; ie ‘non-PO’.

- Where you have localized job approval

- Where you have localized invoice approval

- Where you have remote payment processing

- Where you have a lack of standard auditing procedures

- Where you have no centralized tracking of work orders and invoices

- Where you have high job turnover

- Where forensic audits have uncovered repeated inconsistencies in billing, vendor relationships, and invoice processing (Source: Forensic Auditors Report on Field Service Fraud, 2023)

How to Address and Prevent Maintenance Fraud

1. Implement Work Order Tracking Software

Using a digital system ensures all requests, approvals, and completions are logged and traceable. This prevents unauthorized or fraudulent work orders from slipping through the cracks.

2. Vet and Approve Vendors

Only work with pre-approved vendors who have been properly vetted. Require contracts and W-9s before issuing payments to ensure legitimacy.

3. Conduct Regular Audits and Inspections

Compare invoices with actual work completed. Perform surprise inspections on maintenance jobs to verify quality and necessity.

4. Require Before-and-After Photos

Make it mandatory for vendors and staff to submit photo evidence of repairs. This simple step deters fraud and provides documentation for disputes.

5. Cross-Check Payments

Ensure that vendor payments match approved work orders and completed services. Set up automated flagging for duplicate or excessive charges.

6. Enforce Segregation of Duties Through Centralization

Centralizing maintenance operations can significantly reduce fraud risk by creating clear separation between vendor selection, work coordination, and payment approval. A centralized team ensures multiple layers of oversight, making it harder for fraud to go undetected. This is especially critical for publicly traded companies that must comply with SOX regulations.

7. Leverage Telemaintenance and Teleinspections

Using remote diagnostic tools and virtual inspections can help verify maintenance work before dispatching vendors. Telemaintenance allows property managers to assess problems in real-time, reducing unnecessary service calls and potential fraudulent claims.

8. Recognize High-Risk Environments

Fraud is more likely to persist in settings with high employee turnover, inconsistent data management, and scattered property sites. Strengthening internal controls and standardizing processes across locations helps close these gaps.

9. Encourage Whistleblowing

Create an anonymous reporting system for employees or tenants to report suspected fraud. Many cases come to light through tips from those witnessing unethical behavior firsthand.

10. Avoid Cash Payments

All maintenance expenses should go through traceable transactions. Cash payments make it easy to hide fraudulent activity.

Strengthening Your Property Management Processes

Maintenance fraud isn’t just an inconvenience—it’s a direct hit to profitability and credibility. By implementing strong oversight, centralizing operations, and leveraging technology like telemaintenance, property managers can protect themselves from unnecessary losses while maintaining compliance with SOX regulations.

Next Steps: Start by reviewing your last six months of invoices and work orders—you may be surprised by what you find. Addressing maintenance fraud today will ensure smoother operations and stronger trust with property owners and tenants moving forward.